As you navigate the complex landscape of international trade, you’re likely to come across Standby Letter of Credit (SBLC) providers. But what exactly do they do? You might know that they help facilitate cross-border trade, but that’s just the surface. SBLC providers play a critical role in ensuring payment security for sellers, allowing businesses to expand into new markets with confidence. But how do they mitigate default risks, and what benefits do they bring to international business? You’re about to find out.

SBLC Providers: Mitigating Default Risks

Many SBLC providers have experienced the consequences of a buyer’s default, which can be devastating to their business.

You’re not immune to this risk, and it’s crucial to take proactive measures to mitigate default risks.

One way to do this is by conducting thorough due diligence on potential buyers.

You should verify their creditworthiness, business reputation, and financial stability before issuing an SBLC.

It’s also essential to understand the terms and conditions of the SBLC, including the payment terms, delivery schedule, and dispute resolution mechanisms.

By doing so, you’ll be better equipped to identify potential red flags and take corrective action before it’s too late.

Additionally, you should maintain open communication channels with the buyer and the beneficiary to ensure that the SBLC is utilized as intended.

Facilitating Cross-Border Trade Transactions

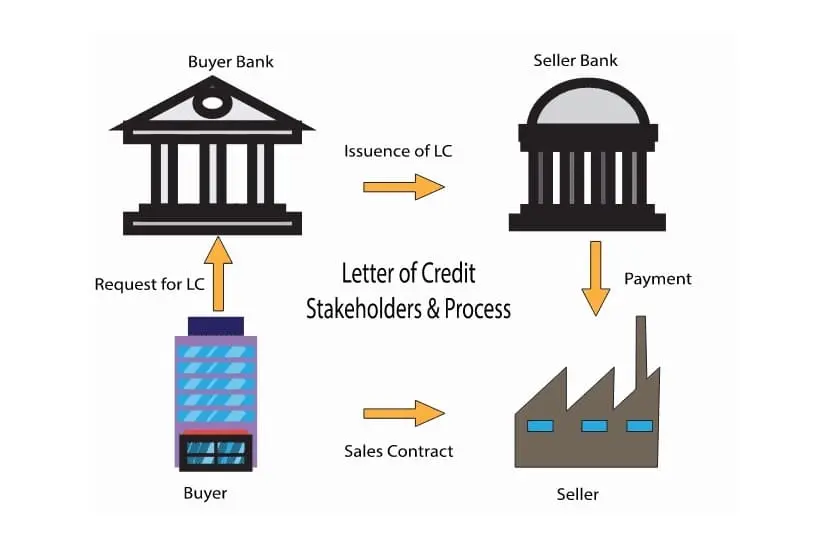

By mitigating default risks, you can confidently facilitate cross-border trade transactions that are secure. This is crucial in international trade, where buyers and sellers often don’t know each other.

With a standby letter of credit (SBLC) in place, you can ensure that your trade transaction is protected against non-payment or non-performance. This gives you the confidence to enter into large-scale trade agreements, knowing that your financial interests are safeguarded.

When you’re involved in cross-border transactions, the stakes are high. Any default or non-payment can lead to significant financial losses.

However, with an SBLC provider, you can mitigate these risks and focus on growing your business. By facilitating secure trade transactions, SBLC providers play a vital role in promoting global trade.

They enable you to expand your business horizons, explore new markets, and increase your revenue streams. By providing a secure and reliable way to conduct cross-border trade, SBLC providers are instrumental in facilitating global trade transactions.

Role in Global Commerce Expansion

You’re looking to expand your business globally, and SBLC providers can be your key enablers.

They help you navigate complex international trade regulations, ensuring compliance that’s both thorough and efficient.

By issuing a Standby Letter of Credit (SBLC), they provide your foreign customers with the assurance they need to trust your company.

This trust translates into increased business opportunities, as you’re now better positioned to tap into new markets and customer bases.

As your business grows, SBLC providers continue to support you, helping you manage risk and facilitating the flow of goods and services across borders.

Their expertise in global commerce enables you to focus on what you do best – running your business.

With an SBLC provider by your side, you can confidently pursue your expansion goals, knowing that you have a reliable partner to guide you through the complexities of international trade.

Ensuring Payment Security for Sellers

At least 70% of international trade relies on credit, which means sellers are often at risk of not getting paid on time or at all.

When you’re a seller, you’re essentially extending credit to your buyer, trusting that they’ll make good on their debt. But what happens when they don’t? You’re left with unpaid debt, and potentially, and a significant dent in your business’s cash flow.

SBLC providers step in to mitigate this risk by providing a guarantee of payment to you, the seller. When a buyer defaults on payment, the Leased SBLC for trade finance ensures you receive the payment you’re owed.

This guarantee gives you peace of mind, allowing you to focus on what you do best: providing high-quality goods and services. With an SBLC, you’re protected from the uncertainty of international trade, and you can confidently expand your business globally.

SBLC Benefits for International Business

Your business can’t afford to be held back by uncertainty. That’s why you need a Standby Letter of Credit (SBLC) to ensure your international transactions are secure and reliable.

With an SBLC, you can confirm the creditworthiness of your buyers, reducing the risk of non-payment. This gives you the confidence to expand your business globally, without worrying about the uncertainty of payment.

You’ll benefit from improved cash flow, reduced financial risk, and enhanced business reputation.

An SBLC also provides a competitive edge in the global market, as it demonstrates your commitment to fulfilling contractual obligations.

Furthermore, it helps you to establish a long-term relationship with your buyers, built on trust and reliability.

By mitigating payment risks, you can focus on what matters most – growing your business.

With an SBLC, you can navigate the complexities of international trade with ease, and take your business to the next level.

Conclusion

You’ve got a clearer picture of SBLC providers’ significance in global finance. They mitigate default risks, facilitating cross-border trade transactions, and ensure payment security for sellers. By doing so, they enable businesses to expand into new markets and revenue streams with confidence. Their expertise supports business growth and risk management, making them a vital component of international commerce.